Shop

Ensco Plc value analysis (NYSE:ESV)

£99.00

Ensco Plc value analysis (NYSE:ESV)

Ensco Plc is a global provider of offshore drilling services to the petroleum industry.

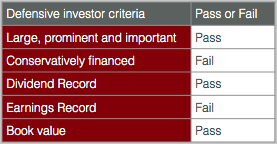

The value analysis of Ensco Plc was interesting due to the very low price to book value of the common stock. The share price used for the value analysis is around $10 per share. At this price the share price is down 70-80% from almost any point in the last 10 years. The low share price makes the current price look very attractive in comparison with the net asset value of the company.

It is true that ESV has made a loss in the last two financial years, but the loss is due to non-cash items. ESV still makes a profit on an operating basis. Value investors who want to understand whether ESV is good value from an earnings point of view will want to take a view of the reported earnings versus the underlying earnings of ESV. The value analysis in the report covers the impact of the reported and underlying earnings on the decision to make an investment for a value investor.

To find out the exact nature of the relationship between the current share price and net asset value and why ESV common stock might be suitable for a value investor click ‘Add to basket’ and follow the instructions to download the new analysis.

Related products

-

Premier Oil (PMO:LSE)

£99.00 -

Astaldi (AST:Milan)

£99.00