New Value Analysis of Inmarsat Plc (LSE:ISAT)

New Value Analysis of Inmarsat Plc (LSE:ISAT)

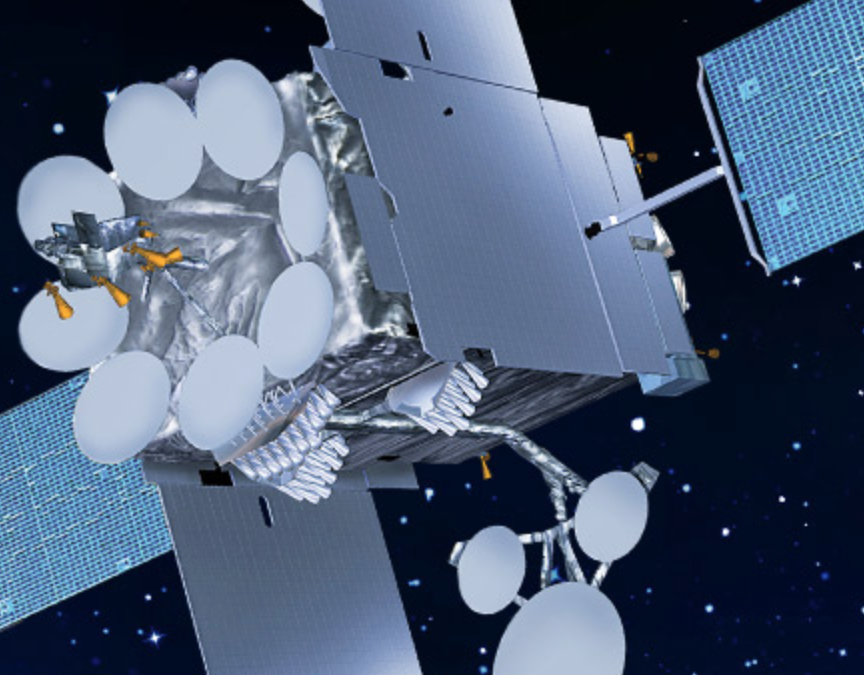

A new value analysis of Inmarsat Plc (LSE:ISAT), a company listed on the London Stock Exchange, has been added to our research pages here. Inmarsat launched the world’s first global mobile satellite communications system to enable merchant ships to stay in touch or call for help in an emergency. Today ISAT owns and operates 11 spacecraft flying in geostationary orbit above the Earth. Inmarsat has customers in merchant shipping, governments, airlines, the broadcast media, the oil and gas industry, mining, construction, and humanitarian aid agencies.

ISAT was the first intergovernmental organisation to transform into a private company in 1999. ISAT went public floating on the London Stock Exchange in 2005.

The value analysis for Inmarsat shows that the company is reasonably priced for earnings and net asset value. The share price has declined about 35% during 2016. It is likely that when the company announced that it would issue new debt in 2016 the share price declined. Inmarsat eventually issued new debt in two issues in August and September 2016.

The increase in debt does create risk for holders of the common stock, but management at Inmarsat has shown they can create good return on financial assets. The return on equity was 22% in 2015. The return on total assets, which accounts for the impact of debt and interest payments, was 25% in 2015.

To find out why a value investor would consider Inmarsat as an invesrtment click here to download the new analysis.

OR

Click the button below to review options on becoming a member.

Free sample

For a free sample of the type of analysis you get from our reports please click Apple Inc or download the PDF on the link below.

[smlsubform prepend=”To receive updates when we add content to our website please use this form to register your e-mail”]