New Value Analysis of Gulf Marine Services Plc 2017 (LSE:GMS)

New Value Analysis of Gulf Marine Services Plc (LSE:GMS)

A new value analysis of Gulf Marine Services Plc (LSE:GMS), a company listed on the London Stock Exchange, has been added to our research pages here. Gulf Marine Services is a global provider of offshore services to the petroleum and renewable energy industries.

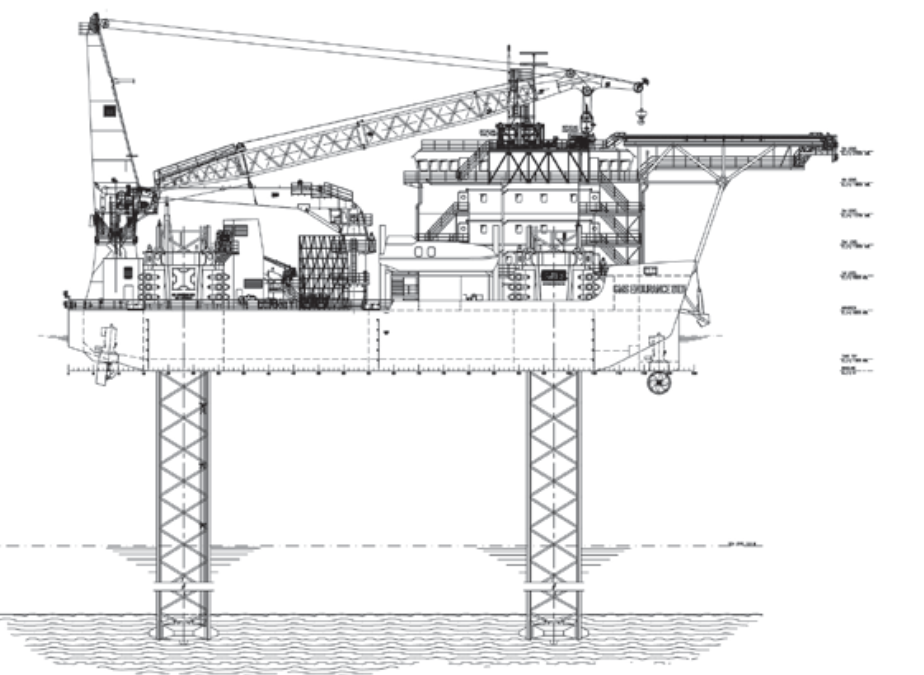

Gulf Marine Services was founded in Abu Dhabi, UAE, in 1977 and has become the largest provider of self-propelled, self-elevating accommodation jackup barges in the world. GMS constructs and maintains its vessels at its yard in Abu Dhabi and has a new build and replacement programme of self elevating support vessels. GMS operates its fleet from its offices in Abu Dhabi, Saudi Arabia and the United Kingdom.

The GMS fleet of self-propelled jackup barges is capable of working in harsh weather environments.

We first analysed GMS in August 2016. At that time GMS had borrowed money to build some new ships. The debt, which was and still is in the form of bank borrowing, creates risk for common stock holders. The price of the common stock had declined about 80% since the initial public offering in 2014, but is somewhat higher than August 2016, which is when we first recommended a purchase of GMS common stock at 36p.

In 2016 the opportunity for value investors was related to the low price, which was and still is well below the value of the assets. Between 2016 and October 2017 the price of the common stock has risen and fallen back again. As shown in this chart from Yahoo Finance.

The recent decline in the stock price is related to decline in revenue and profit in the 2017 half year report. A summary of the report can be found here. However, the decline in price as a result of the decline in earnings has provided another opportunity for value investors with an ability to manage higher risk positions to buy assets at about half their value.

To find out the exactly how cheap GMS is in comparison to its assets and a comparison to its earnings click here to download the new analysis.

OR

Click the button below to review options on becoming a member.

Free samples

For a couple of free samples of the type of analysis you get from our reports please click Apple Inc or Apple Inc 2016 or download the PDF’s in the links below.

[smlsubform prepend=”To receive updates when we add content to our website please use this form to register your e-mail”]