Shop

New Value Analysis of The Procter & Gamble Company (NYSE:PG)

£99.00

New Value Analysis of The Procter & Gamble Company (NYSE:PG)

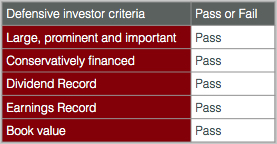

A new value analysis of The Procter & Gamble Company (NYSE:PG), a company listed on the NYSE, has been added to our research pages. Procter & Gamble is a global consumer products producer. Procter & Gamble make products for brushing teeth, washing hair, showering, shaving,caring for the baby, cleaning the house, doing the dishes and the laundry.

The interesting element when analysing PG from a value perspective is considering whether the PG common stock will ever be for sale at a significantly low price. When looking at the price history you can find a relatively low price of $47 per share in 2009, but even at this low price the PE ratio would have been around 12 – 13 times. This would have been the only time in the 20 years when a value investor could have purchased PG for a relatively low earnings multiple.

In 2007 the price of PG peaked at around $70 and the PE ratio was around 23. Buying in2007 would have been a painful decision for holders of the common stock unless the purchaser was really only interested in the income. The price of the common stock did not trade above $70 until 2012.

The current PE is around 24, so there is some similarity to 2007 and this creates some risk for purchasers of the common stock at around the current price of $90. The yield in 2007 was around 2.9% so this is also similar to today.

However, there are also some differences between now and 2007. Earnings do not seem as high as they were in 2007. Earnings had been rising for a number of years in succession and would eventually peak in 2009. Current earnings are below the 2014 number and have come up from a very low level in 2015. The relatively average current earnings level provides some protection to owners of the common stock purchasing around $90.

Purchase the value analysis of Procter & Gamble Company

To find out the exactly why a value investor should consider an investment in Procter & Gamble common stock click ‘Add to basket’. Then follow the instructions to download the analysis.

Related products

-

National Grid (NG:LSE)

£99.00